IRRV Alert - week ending 29th January 2021

Information Letters

News

Circulars

Reports

Individual Insolvency Statistics: October to December 2020 (29 January 2021)

National Statistics

Individual Insolvency Statistics: October to December 2020

Statistics on new individual insolvencies in England and Wales, and related statistics for Scotland and Northern Ireland

Published 29 January 2021

From:

Applies to:

Wales, England, and Scotland

Documents

Commentary - Individual Insolvency Statistics October to December 2020

PDF, 375KB, 16 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

Data Tables in Excel (xlsx) Format - Individual Insolvency Statistics October to December 2020

MS Excel Spreadsheet, 615KB

This file may not be suitable for users of assistive technology.

Request an accessible format.

Data Tables in Open Document Spreadsheet (ods) Format - Individual Insolvency Statistics October to December 2020

ODS, 188KB

This file is in an OpenDocument format

This file may not be suitable for users of assistive technology.

Request an accessible format.

Infographic - Individual Insolvency Statistics Annual

PDF, 177KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

Trader Bankruptcies by Industry in Excel (xlsx) Format - Individual Insolvency Statistics October to December 2020

MS Excel Spreadsheet, 651KB

This file may not be suitable for users of assistive technology.

Request an accessible format.

Trader Bankruptcies by Industry in Open Document Spreadsheet (ods) Format - Individual Insolvency Statistics October to December 2020

ODS, 204KB

This file is in an OpenDocument format

This file may not be suitable for users of assistive technology.

Request an accessible format.

CSV Tables - Individual Insolvency Statistics October to December 2020

This file may not be suitable for users of assistive technology.

Request an accessible format.

Pre-Release Access List - Individual Insolvency Statistics October to December 2020

PDF, 29KB, 1 page

This file may not be suitable for users of assistive technology.

Request an accessible format.

Details

This statistics release contains the latest data on individual insolvency (people who are unable to pay debts and enter formal procedures).

Statistics are presented separately for England and Wales, Scotland, and Northern Ireland because of differences in legislation and policy.

Main messages:

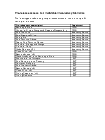

Individual insolvencies in Q4 2020

Overall numbers of individual insolvencies in England and Wales increased in Q4 2020 when compared with Q3 2020, and were higher than during the same quarter in the previous year.

This increase was largely driven by individual voluntary arrangements, although these tend to be volatile and were particularly low in Q3.

Bankruptcies increased while debt relief orders decreased in the latest quarter, though both remain low.

Individual insolvencies in 2020

There were fewer total individual insolvencies in 2020 than in 2019.

This was driven by a decrease in both bankruptcies and debt relief orders.

Individual voluntary arrangements were slightly higher in 2020 than in 2019, although this increase was smaller than has been seen in recent years.

The reduction in individual insolvencies in 2020 compared with 2019 was likely to be partly driven by Government measures put in place in response to the coronavirus (COVID 19).

Published 29 January 2021