IRRV Alert - week ending 31st July 2020

News

Reports

Tax avoidance schemes: accelerated payments (31 July 2020)

Transparency data

Tax avoidance schemes: accelerated payments

A list of tax avoidance schemes on which users may be charged an upfront tax payment called 'an accelerated payment'.

Published 15 July 2014

Last updated 31 July 2020 — see all updates

From:

Documents

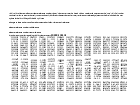

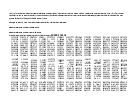

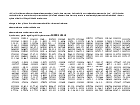

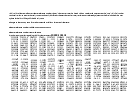

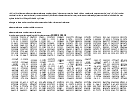

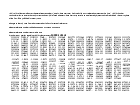

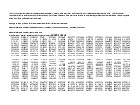

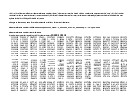

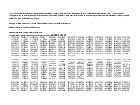

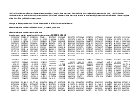

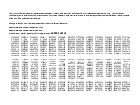

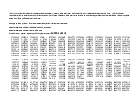

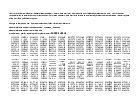

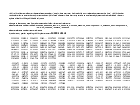

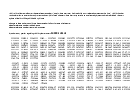

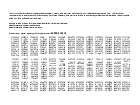

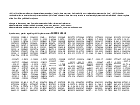

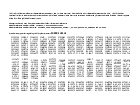

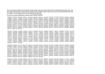

Reviewed Tax Avoidance Scheme Reference Numbers

HTML

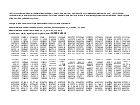

Reviewed Tax Avoidance Scheme Reference Numbers: January 2020

PDF, 225KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

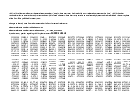

Reviewed Tax Avoidance Scheme Reference Numbers: October 2019

PDF, 225KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

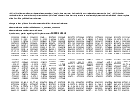

Reviewed Tax Avoidance Scheme Reference Numbers: July 2019

PDF, 281KB, 5 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: April 2019

PDF, 193KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: January 2019

PDF, 133KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: October 2018

PDF, 225KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: July 2018

PDF, 226KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: April 2018

PDF, 136KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: January 2018

PDF, 132KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: October 2017

PDF, 133KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: September 2017

PDF, 131KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: July 2017

PDF, 224KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: April 2017

PDF, 199KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: January 2017

PDF, 199KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: October 2016

PDF, 198KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: July 2016

PDF, 199KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: April 2016

PDF, 219KB, 5 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: January 2016

PDF, 215KB, 5 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: October 2015

PDF, 195KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: July 2015

PDF, 194KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: April 2015

PDF, 196KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: January 2015

PDF, 60.3KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: October 2014

PDF, 70.2KB, 4 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Reviewed Tax Avoidance Scheme Reference Numbers: July 2014

PDF, 56.5KB, 3 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Details

Those who use a disclosed avoidance scheme on this list may be required to pay an upfront payment of tax called ‘an accelerated payment’.

HM Revenue and Customs (HMRC) gives an avoidance scheme a scheme reference number (SRN) when a promoter notifies HMRC of the scheme under the rules for disclosing a tax avoidance scheme (DOTAS). Users will need to make an accelerated payment of tax to HMRC on some DOTAS schemes while the scheme is under dispute with HMRC.

Users of those schemes with a reference number on the linked list above are those who may receive a notice to make an accelerated payment. For an Accelerated Payment Notice to be issued for any specific scheme included on this list, the criteria in the legislation will need to be met.

HMRC began to phase in the issue of notices in August 2014. The list contains SRNs rather than scheme names as taxpayers will have used this to identify their use of an avoidance scheme when completing their Self Assessment return. Promoters of avoidance schemes are also not required to disclose scheme names to HMRC. The SRN is all the user will need in order to identify whether their scheme is on the list.

If you cannot remember your SRN, contact your agent or advisor, or HMRC on 03000 530435.

If you want to settle an avoidance issue now please call HMRC on 03000 530435. If you are a High Net Worth Unit or Large Business customer, please contact your Customer Relationship Manager.

If you have a query about the linked list of SRNs, please call HMRC on 03000 530435.

The accelerated payment regime was announced at Budget 2014, (Accelerated payments of tax for avoidance schemes) and has been brought into law in Finance Act 2014, Part 4. It’s been introduced to tackle the very small minority of taxpayers who use tax avoidance schemes.

Find out more about how HMRC deals with Tax Avoidance on HMRC’s Tax Avoidance pages.

If you are worried that you may be involved in tax avoidance but don’t appear to have an SRN, please read HMRC’s Tax avoidance: an introduction pages. They give some common indicators for avoidance. HMRC also publishes Spotlights, a warning on current avoidance issues.

Guidance on the measures brought into law can be found at the follower notice and accelerated payment guide.

Published 15 July 2014

Last updated 31 July 2020 + show all updates