IRRV Alert - week ending 11th September 2020

News

Consultations

Reports

Tax avoidance: general anti-abuse rule guidance - earlier versions (11 September 2020)

Guidance

Tax avoidance: general anti-abuse rule guidance - earlier versions

Use the version of the guidance that was published when the arrangements were entered into. The latest version was published on 28 March 2018.

Published 15 April 2013

Last updated 11 September 2020 — see all updates

From:

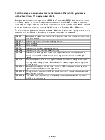

Documents

GAAR guidance Parts A, B and C: 28 March 2018

PDF, 417KB, 41 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance Part D: 31 March 2017

PDF, 1.01MB, 133 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance Part E: 28 March 2018

PDF, 433KB, 36 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to parts A, B and C of the 28 March 2018 version

PDF, 100KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to part D of the 31 March 2017 version

PDF, 101KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to part E of the 28 March 2018 version

PDF, 103KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance parts A, B and C: 31 March 2017

PDF, 599KB, 41 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance part E: 31 March 2017

PDF, 493KB, 36 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to parts A, B and C of the 31 March 2017 version

PDF, 225KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to part E of the 31 March 2017 version

PDF, 239KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance parts A, B and C: 30 January 2015

PDF, 406KB, 34 pages

GAAR guidance part D: 30 January 2015

PDF, 843KB, 132 pages

GAAR guidance part E: 30 January 2015

PDF, 423KB, 25 pages

Amendments to parts A, B and C of the 30 January 2015 version

PDF, 249KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to part D of the 30 January 2015 version

PDF, 327KB, 2 pages

This file may not be suitable for users of assistive technology. Request an accessible format.

Amendments to part E of the 30 January 2015 version

PDF, 246KB, 1 page

This file may not be suitable for users of assistive technology. Request an accessible format.

GAAR guidance parts A, B and C: 15 April 2013

PDF, 160KB, 35 pages

GAAR guidance part D: 15 April 2013

PDF, 435KB, 136 pages

GAAR guidance part E: 15 April 2013

PDF, 160KB, 24 pages

Amendments to parts A, B and C of the 15 April 2013 version

PDF, 194KB, 4 pages

Amendments to part D of the 15 April 2013 version

PDF, 216KB, 9 pages

Amendments to part E of the 15 April 2013 version

PDF, 191KB, 2 pages

Details

You can use these earlier versions along with the latest version of the general anti-abuse rule (GAAR) guidance to help you recognise abusive tax arrangements and the process for counteracting them.

Part E of the latest guidance is relevant to all tax arrangements.

The amendment notes show you what’s changed in each version of the GAAR guidance.

If you have any feedback about the GAAR, email: gaar.enquiries@hmrc.gov.uk

Published 15 April 2013

Last updated 11 September 2020 + show all updates